tax deductions for high income earners 2019

Any remaining credit calculated on Schedule 11 by a student can be transferred to one of the following individuals. Alberta also lacks a sales tax payroll tax and health premium which leaves thousands more in the pockets of its residents.

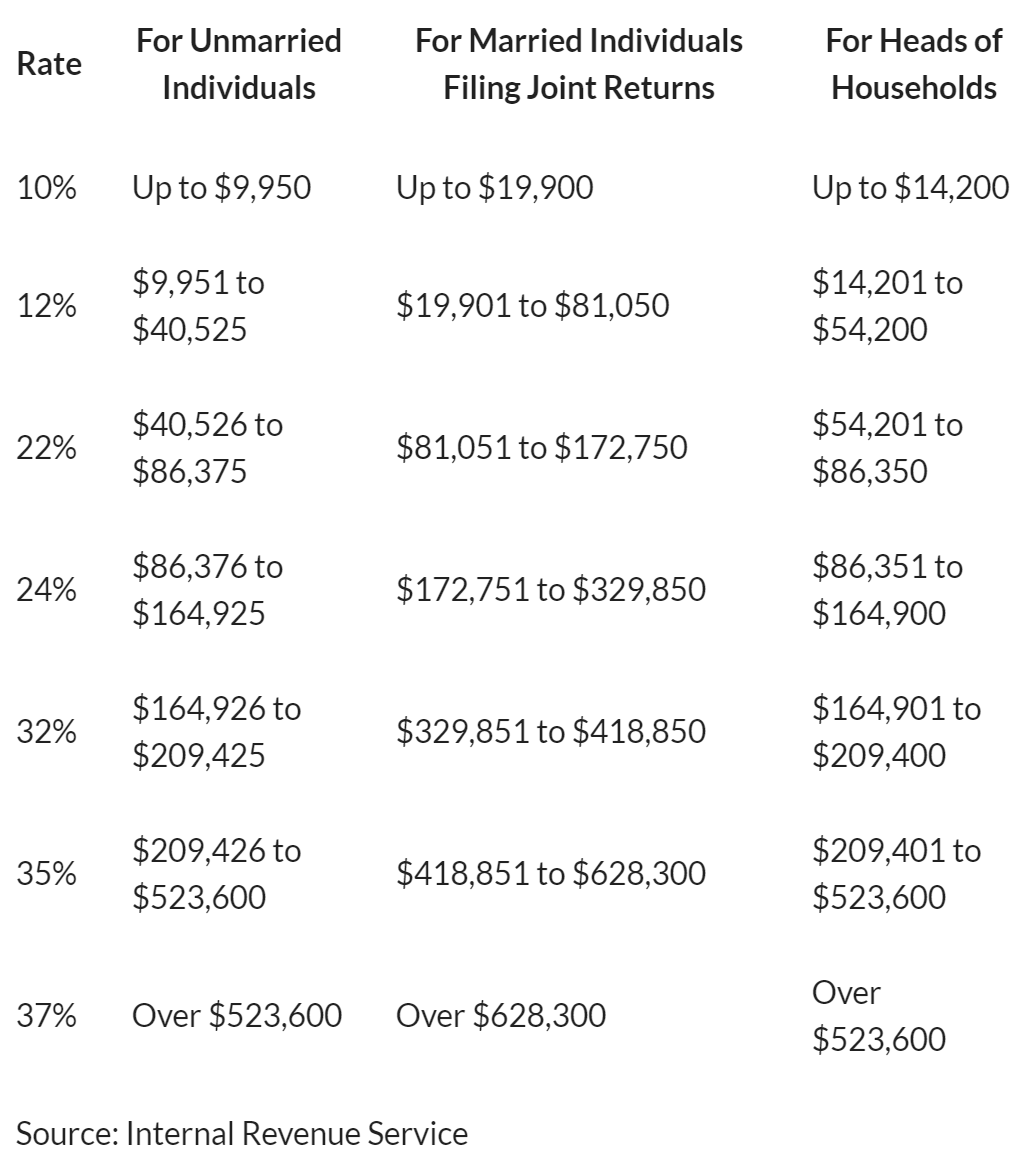

Does A 40 Tax Bracket Mean The Government Takes 40 Of Your Income Quora

Claiming deductions credits and expenses.

. Alberta is one of the best places to live from a tax perspective if youre a very low or very high-income earner. Line 32400 was line 324 before tax year 2019. Only one person can claim this transfer from the student.

Caps the tax benefit of itemized deductions to 28 percent of value for those earning more than 400000 which means that taxpayers earning above that income threshold with tax rates higher than 28 percent would face limited itemized deductions. Line 32400 Tuition amount transferred from a child. It does not need to be the.

For very high-income earners the tax rate tops out at just 15 and thats only on the portion of the income you earn over 314928. Restores the Pease limitation on itemized deductions for taxable incomes above 400000.

Tax Strategies For High Income Earners Wiser Wealth Management

The 4 Tax Strategies For High Income Earners You Should Bookmark

The Hierarchy Of Tax Preferenced Savings Vehicles

5 Outstanding Tax Strategies For High Income Earners

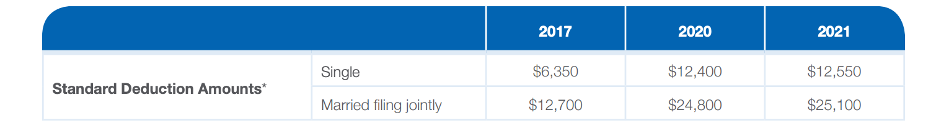

How The Tcja Tax Law Affects Your Personal Finances

5 Outstanding Tax Strategies For High Income Earners Debt Free Dr Dentaltown

Chiropractic And How To Reduce Taxes For High Income Earners

Tax Strategies For High Income Earners Wiser Wealth Management

Itemized Deduction Who Benefits From Itemized Deductions

Summary Of The Latest Federal Income Tax Data 2022 Update

Which States Allow Deductions For Federal Income Taxes Paid Itep

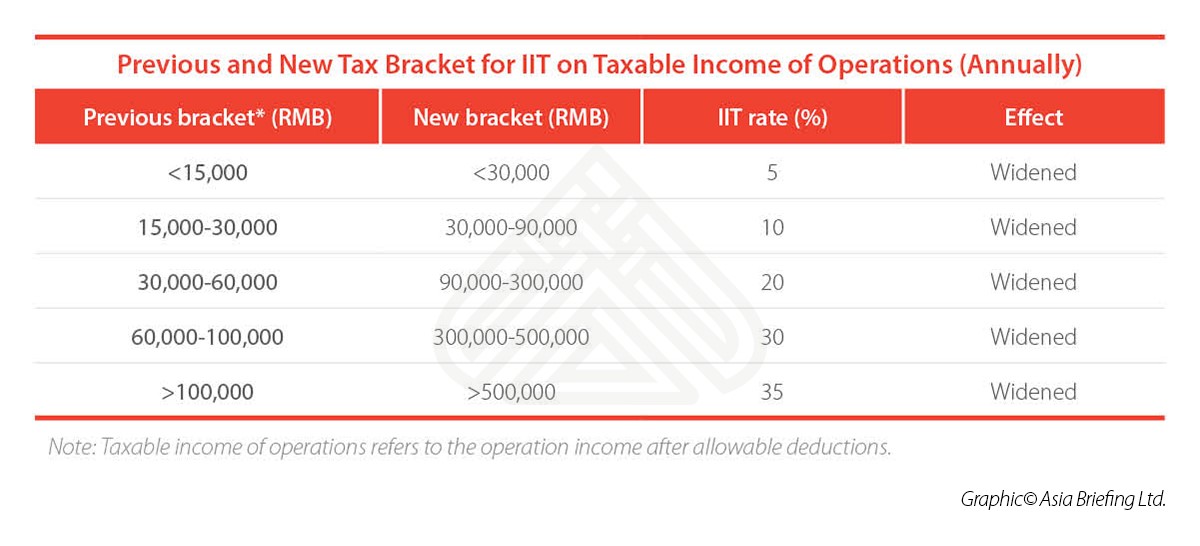

China S New Iit Law Prepare For Transition China Briefing News

2019 Budget Income Tax Cuts From 1 July 2018 Moschners Chartered Accountants

Tax Strategies For High Income Earners

How Do Taxes Affect Income Inequality Tax Policy Center

Tax Strategies For High Income Earners Wiser Wealth Management

How The Tcja Tax Law Affects Your Personal Finances

Tax Strategies For High Income Earners Wiser Wealth Management