does california have estate or inheritance tax

Generally speaking inheritance is not subject to tax in California. The information below summarizes the filing requirements for Estate Inheritance andor Gift Tax.

California Estate Tax Everything You Need To Know Smartasset

As noted above although california doesnt have an inheritance tax residents of the state can be affected by the laws of states that have such a tax.

. But the good news is that California does not assess an inheritance tax against its residents. Ad From Fisher Investments 40 years managing money and helping thousands of families. We also offer a robust overall tax-planning service for high net-worth families.

Ad Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms. If you are getting money from a relative who lived in another state though make sure you check out that. However this doesnt mean that inheritance taxes cant affect California residents who leave assets to individuals in.

The California Inheritance Tax and Gift Tax As I previously mentioned there is no inheritance tax in California regardless of net worth. Currently fourteen states and the District of Columbia impose an estate tax while six states. However the estate still has to file tax returns.

Estate taxAs the grantor or bequeather paying estate taxes is your responsibility not the heirs or beneficiaries. Lets say you live in Californiawhich does not have an inheritance taxand you inherit from your uncles estate. That this does not necessarily mean that your inheritance will be.

12 What about capital gains tax. Does California Impose an Inheritance Tax. Twelve states and the District of Columbia impose estate taxes and six impose inheritance taxes.

If you are a beneficiary you will not have to pay tax on your inheritance. This is huge for my California financial. 11 Inheritance tax vs estate tax.

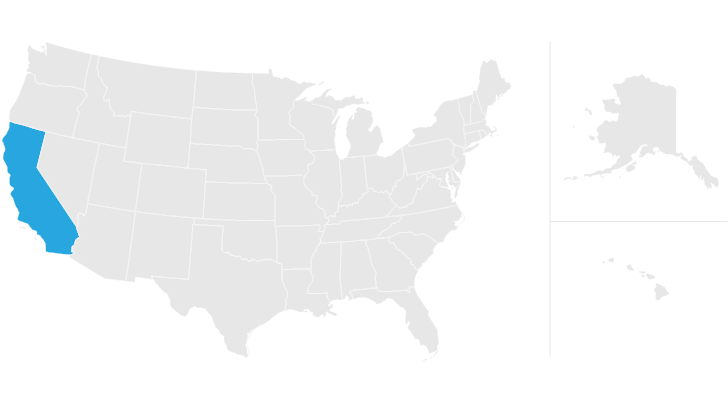

Like the majority of states there is no inheritance tax in California. Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. There are no estate or inheritance taxes in California.

He lived in Kentucky at the time of his death. California Legislators Repealed the State Inheritance Tax in 1981. Get Access to the Largest Online Library of Legal Forms for Any State.

Maryland is the only state to impose both now that New Jersey has repealed. There are only 6 states in the country that actually impose an inheritance tax. There are a few exceptions such.

California previously did have what was called an inheritance tax which acted similar to an estate tax. Like most US. States California doesnt have an inheritance tax meaning that if youre a beneficiary you wont have to pay tax on your inheritance.

That being said California does not have an inheritance tax. California is part of the 38 states that dont impose their own estate tax on inheritances. The state of California does not impose an inheritance tax.

People often use the terms. As of 2021 12 states plus the District of Columbia impose an estate tax. En español Most people dont have to worry about the federal estate tax which excludes up to 1206 million for individuals and 2412 million for married couples in 2022 up.

And even for the federal. 117 million increasing to 1206 million for deaths that. For decedents that die on or after January 1 2005 there is no longer a requirement to file a.

Ad Over 27000 video lessons and other resources youre guaranteed to find what you need. EIN Employer Identification Number. However California is not among them.

2 How to Avoid Inheritance Tax and Capital Gains. For most individuals in California People who are starting the estate planning process often wonder about the potential estate or inheritance tax implications. If you are a California resident you do not need to worry about paying an inheritance tax on the money you inherit from a.

Ad From Fisher Investments 40 years managing money and helping thousands of families. In addition to the federal estate tax of 40 percent which is Facts Figures. A federal estate tax is in effect as of 2021 but the exemption is significant.

As stated above California does not impose taxes on estates or inheritances. However california is not among them. We have offices throughout California and we offer in-person phone and Zoom appointments.

1 Federal State and Inheritance Tax on House Rules Explained. In California there is no state-level estate or inheritance tax. Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios.

California inheritance laws especially when there isnt a valid will in place can get a bit convoluted.

How Much Is Inheritance Tax Community Tax

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Is Inheritance Taxable In California California Trust Estate Probate Litigation

Webuyhomes In California Area Cash Fast We Buy Houses Being A Landlord Solutions

State Estate And Inheritance Taxes Itep

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Need A Inheritance Tax Waiver Form Templates Here S A Free Template Create Ready To Use Forms At Formsbank Com Inheritance Tax Templates Tax Forms

States With No Estate Tax Or Inheritance Tax Plan Where You Die

How Much Is Inheritance Tax Community Tax

California Inheritance Tax Inheritance Tax In California Lawyer Legalmatch

Pennsylvania Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

State Death Tax Is A Killer The Heritage Foundation

How To Avoid Estate Taxes With A Trust

What Inheritance Taxes Do I Have To Pay The Heritage Law Center Llc

California Estate Tax Everything You Need To Know Smartasset

Taxes On Your Inheritance In California Albertson Davidson Llp